As investors eagerly anticipate the market's trajectory, understanding the impact of key ETFs like SSO becomes paramount. This thorough analysis delves into the current performance of the SSO ETF, focusing on its exceptional returns within the context of the ongoing bull market. The thriving economic climate has stimulated growth across various sectors, and SSO has consistently capitalized on this opportunity.

- , Historically, Over time

- The SSO ETF offers a strategic approach to participating in the ever-changing market.

Investors seeking growth within a volatile landscape often turn to ETFs like SSO. Dissecting its performance allows us to gauge its potential for future success.

Leveraging Returns with SSO: A Look at ProShares Ultra S&P 500 ETF

ProShares Ultra S&P 500 ETF (SSO) provides investors a compelling approach to amplify their returns amidst the dynamic S&P 500 index. SSO, as a leveraged exchange-traded fund, aims to deliver double the daily performance of its underlying benchmark. This design makes SSO an appealing option for individuals seeking to capitalize market upswings.

However, it's crucial the inherent challenges associated with leveraged ETFs is paramount. Daily adjustments can result deviations Leveraged S&P 500 ETF investing strategy from the target long-term performance.

As a result, it's essential for traders to conduct thorough research and carefully consider their financial goals before allocating capital to SSO.

Decoding SSO's Outcomes: Factors Influencing the 2x Leveraged S&P 500 ETF

Unveiling the dynamics of the multiplied S&P 500 ETF, known as SSO, requires a sharp understanding of the factors that impact its volatility. A key component is the built-in nature of leverage, which doubles both returns and losses. SSO, with its 2x coefficient, submits investors to a intensified level of vulnerability compared to the traditional S&P 500 index.

Beyond leverage, market trends play a dominant role in shaping SSO's trajectory. A upward market tends to elevated returns for SSO, while a bearish market exacerbates its deficits.

Additionally, investor sentiment can influence SSO's valuation. During periods of volatility, investors may redirect their funds away from amplified products like SSO, leading to changes in its value.

SSO ETF and SPY ETFs: Evaluating Performance in Diverse Market Conditions

Investors constantly search for optimal investment strategies to enhance returns. Two popular choices within the exchange-traded fund (ETF) landscape are the Direxion Daily S&P 500 Bull 3X Shares, which provides amplified exposure to the S&P 500, and the SPY ETF, a traditional ETF tracking the same index. Understanding their performance across different market environments is crucial for making informed investment decisions.

In positive markets, SSO typically surpasses SPY due to its multiplied structure. However, bearish markets can pose considerable risks for SSO investors as losses are increased. SPY, with its unleveraged exposure, lessens these downside risks.

- Variables influencing the relative performance of SSO and SPY include market volatility, participant sentiment, and macroeconomic conditions.

- Regularly monitoring these factors can help portfolio managers adjust their strategies to align prevailing market conditions.

Unveiling the Dynamics of SSO: A Comprehensive Look at a 2x Leveraged S&P 500 Approach

A leveraged exchange-traded fund (ETF) tracking the S&P 500 index, often known as a magnified ETF, presents both enticing rewards and inherent risks for investors. These funds aim to deliver double the daily returns of the benchmark index, attracting those seeking amplified exposure within the stock market. However, the intrinsic leverage also amplifies losses, making it crucial for investors to thoroughly understand the potential downsides before allocating capital.

- Understanding the Impact of Leverage: A Key Factor in SSO Investment Decisions

- Diversification Strategies

- Monitoring and Rebalancing

{Ultimately, investing in a 2x leveraged S&P 500 strategy requires an disciplined approach that entails thorough risk management and regular portfolio monitoring. While the potential for considerable returns exists, investors must be well-informed of the inherent risks involved.

SSO ETF Performance Review: Evaluating its Potential for Long-Term Gains

The SSO ETF, known for its leveraged exposure to the technology sector, has recently seen shifts in its performance. To truly understand its potential for long-term gains, investors must scrutinize a range of factors. A thorough review should include examining historical trends, assessing the current market environment, and considering the ETF's fundamentals.

- Furthermore

- it is essential to understand the risks associated with leveraged ETFs, as their performance can be exceedingly sensitive to market shifts.

,Finally, a well-rounded analysis of SSO ETF performance can provide valuable knowledge for investors looking to navigate the technology sector's potential for growth.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! James Van Der Beek Then & Now!

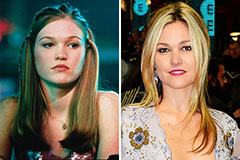

James Van Der Beek Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!